HEI Fixed Income Market Commentary

- Global markets ended in negative territory following U.S corporate earnings and a sell-off in their high-growth and technology stocks amid rising U.S Treasury yields. This also led to Brent crude falling around $90 per barrel while gold also declined, trading around $1,760 an ounce as low demand arises in the global economy

- In the domestic market, the NSX bourse also closed in negative territory declining by -0.76% on the backdrop of global risk aversion following more hawkish commentary from the Federal Reserve (Fed Inflation data from the Namibian Statistic Agency (NSA) showed inflation remained constant at 7.1% for September and October, thus creating different perceptions on bond yields, with some declining and others increasing.

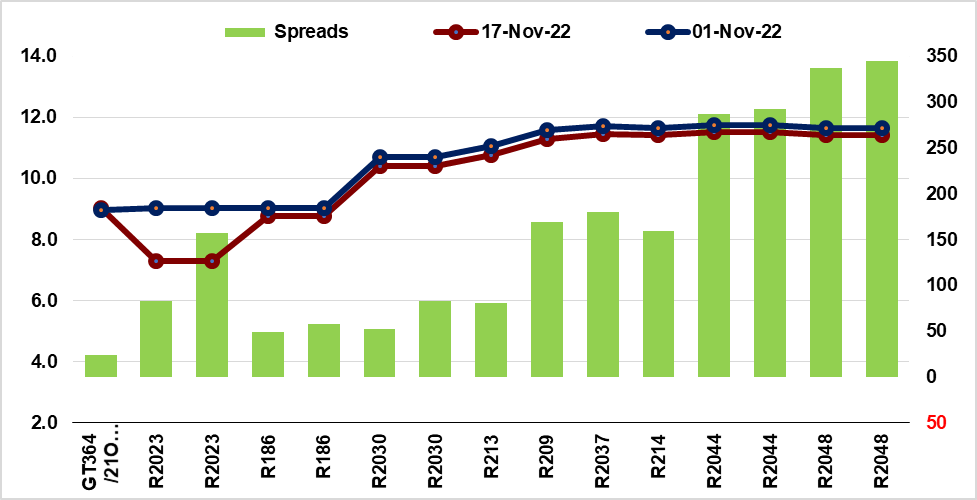

- In South Africa, the sovereign spread is highly correlated with the Volatility Index (VIX) of 40, while the VIX itself is 26, indicating just how volatility the bonds reach to global market factors such as inflation and interest rates which caused the yields to decline due to market forces mentioned earlier.

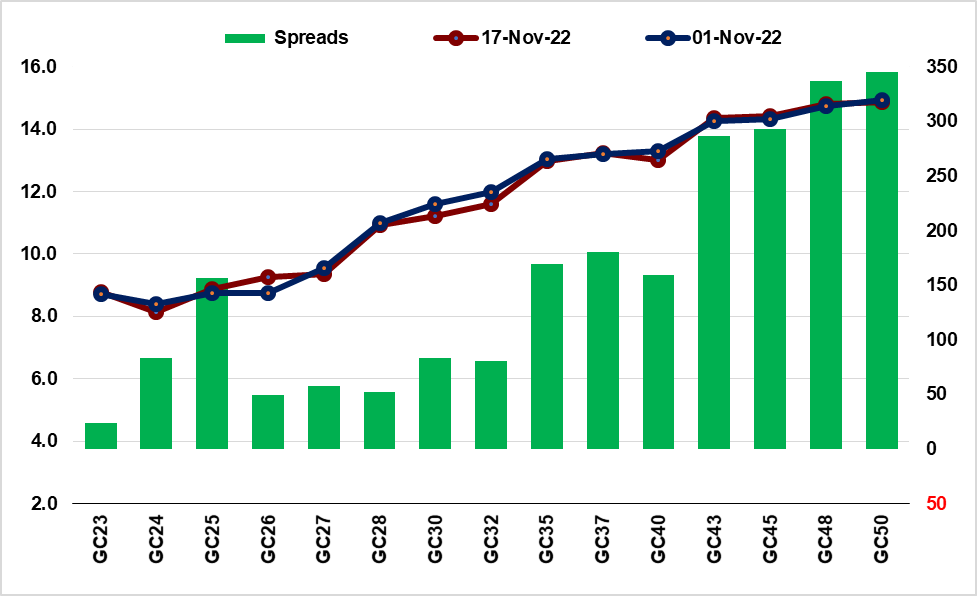

- The spreads increased on bonds maturing more than 30 years while they decreased on those less than 30 years mirroring investors’ preference for the type of bonds.

Table 1. Namibia Government Bonds

| Bonds | Coupon | Maturity | YTM (%) | YTM (%) | YTM (%) | DTDΔ | MTDΔ | Prices |

| 01-Nov-22 | 16-Nov-22 | 17-Nov-22 | (bps) | (bps) | 17-Nov-22 | |||

| GC23 | 8.85 | 15-Oct-23 | 8.73356 | 8.796 | 8.7961 | 0 | 6 | 100.0331 |

| GC24 | 10.5 | 15-Oct-24 | 8.39655 | 8.064 | 8.133 | 7 | 26 | 104.1061 |

| GC25 | 8.5 | 15-Apr-25 | 8.75044 | 8.803 | 8.872 | 7 | 12 | 99.19414 |

| GC26 | 8.5 | 15-Apr-26 | 8.75044 | 9.202 | 9.2709 | 7 | 52 | 97.77303 |

| GC27 | 8 | 15-Jan-27 | 9.56143 | 9.288 | 9.3568 | 7 | 20 | 95.38884 |

| GC28 | 8.5 | 15-Oct-28 | 11.00824 | 10.835 | 10.9248 | 9 | 8 | 89.61945 |

| GC30 | 8 | 15-Jan-30 | 11.61090 | 11.138 | 11.2269 | 9 | 38 | 84.37724 |

| GC32 | 9 | 15-Apr-32 | 11.98047 | 11.509 | 11.5894 | 8 | 39 | 85.37487 |

| GC35 | 9.5 | 15-Jul-35 | 13.04905 | 12.843 | 12.9828 | 14 | 7 | 78.59551 |

| GC37 | 9.5 | 15-Jul-37 | 13.21063 | 13.053 | 13.2496 | 20 | 4 | 75.97984 |

| GC40 | 9.8 | 15-Oct-40 | 13.31630 | 12.943 | 12.9998 | 6 | 32 | 77.94202 |

| GC43 | 10 | 15-Oct-43 | 14.26186 | 14.207 | 14.3748 | 17 | 11 | 71.25645 |

| GC45 | 9.85 | 15-Jul-45 | 14.34203 | 14.252 | 14.4349 | 18 | 9 | 69.54879 |

| GC48 | 10 | 15-Oct-48 | 14.73519 | 14.59865 | 14.7936 | 19 | 6 | 68.83244 |

| GC50 | 10.25 | 15-Jul-50 | 14.94886 | 14.69821 | 14.8695 | 17 | 8 | 69.48046 |

Figure 1. Namibia Bond Yield: 01-Nov-2022 vs. 17-Nov-2022

Figure 1. South African Bond Yields: 01-Nov-2022 vs. 17-Nov-2022

Source: BoN & HEI Research