Analysis

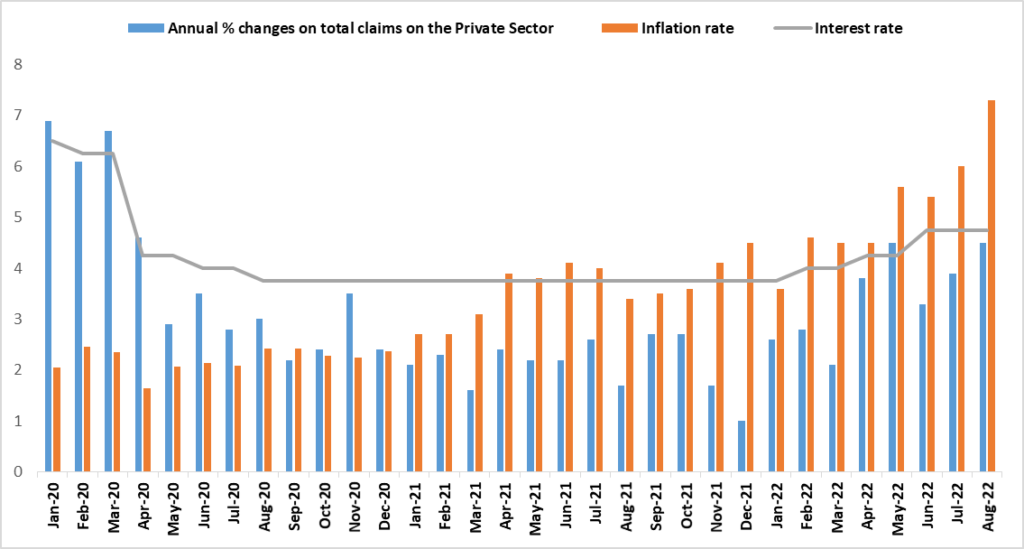

Credit extended to the private sector (individuals and businesses) increased to N$ 109,737 million from N$ 109,298 million recorded in July 2022. This translated into a slight monthly increase of 0.4%. The increase continues to be at the backdrop of an upturn in demand for credit by businesses for overdrafts and other loans and advances, while growth for households declined significantly as the cost of living continues to rise. See figure 1 below.

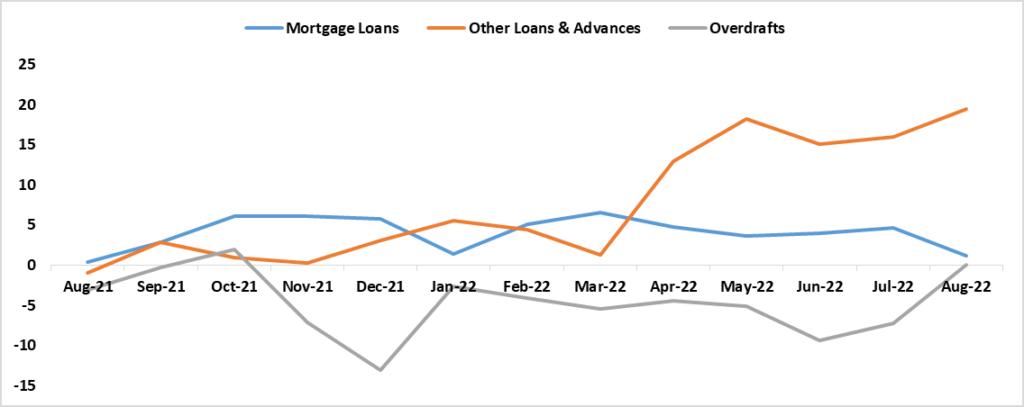

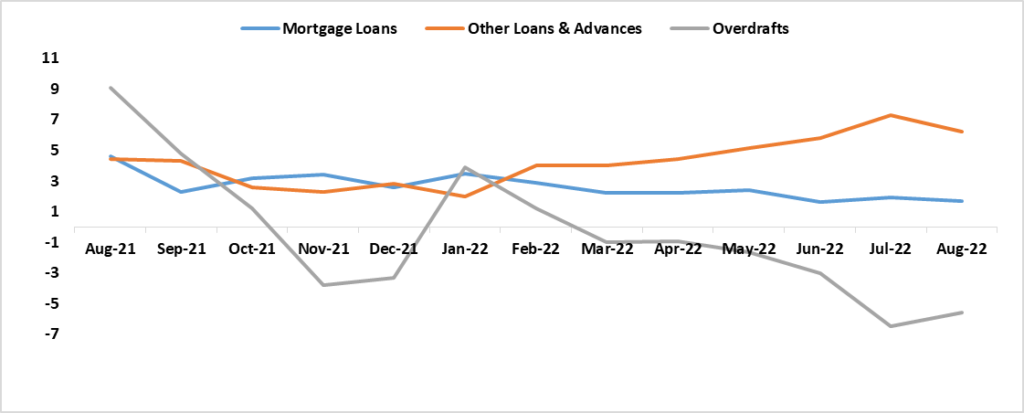

On an annual basis, total credit extended to the private sector increased by 4.5% in August up from 1.7% recorded in August 2021. This was mainly derived from growth recorded for overdrafts and other loans and advances for businesses by 0.1% and 19.4%, respectively. This is an indication that confidence is returning albeit at a slow pace. According to the Bank of Namibia, businesses in the mining and service sectors have become the main contributors to businesses’ credit growth due to the high demand for overdrafts which has drastically increased, recovering from negative territory. However, the demand for credit for households recorded no growth during the period under review. This clearly indicates that households lack the confidence to take up credit. See Figures 2 & 3.

Figure 1: Annual % growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2020- August 2022)

Figure 2: Annual % changes for Credit Extended to Businesses per category, (August 2021-August 2022)

Figure 3: Annual % changes for Credit Extended to Individuals per category, (August 2021-August 2022)

Outlook

The continuous improvements in domestic economic activity especially in the mining and services sectors could drive up the demand for credit in the short to medium term. We project a minimal growth in the Private Sector Credit Extension for the remaining months of 2022. Notwithstanding this, the anticipated monetary policy tightening by the central bank could also threaten businesses and individuals confidence to take up credit.