Analysis

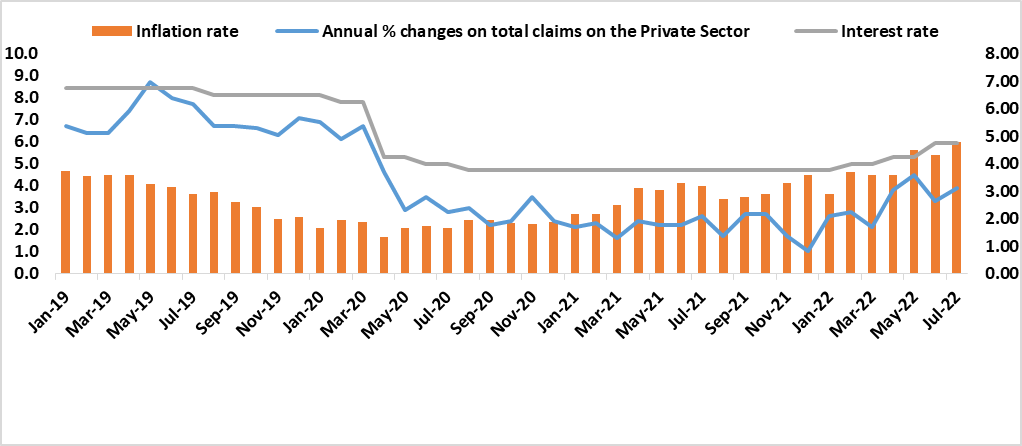

Total credit extended to the private sector (individuals and businesses) amounted to N$ 109,323 million for July 2022 from N$ 108,963 million recorded in June 2022. This translated into a slight increase of 0.3%. The increase was against the backdrop of an upturn in demand for credit by businesses for the category of other loans and advances and the mortgages category for households augmented an increase in the standard of living. See figure 1 below.

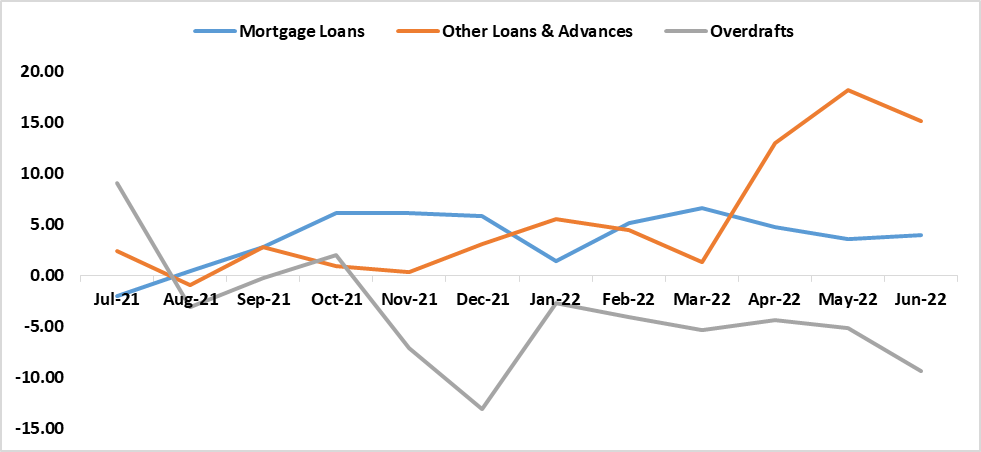

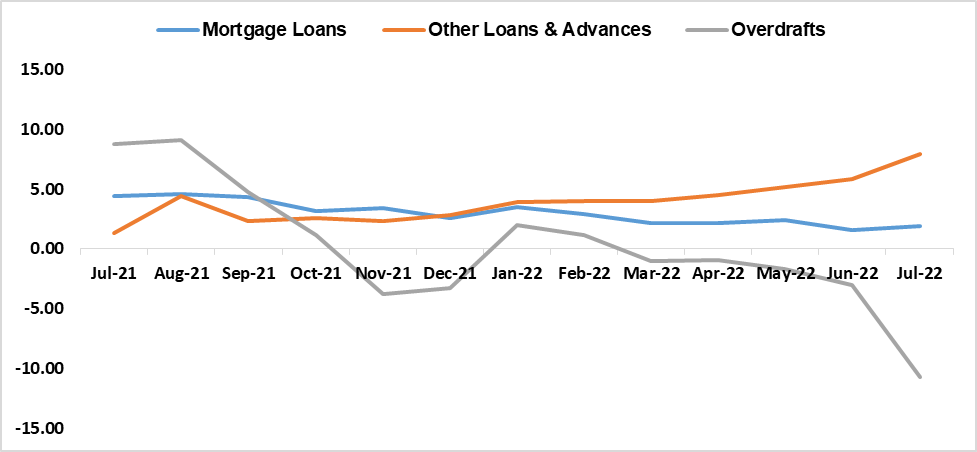

On an annual basis, total credit extended to the private sector increased by 3.9% up from 3.4% recorded in July 2021. An increase in the annual growth rate was mainly derived from growth recorded for other loans and advances for businesses and the uptake for mortgage credit for both households and businesses by 15.7% and 7.9%, respectively. This is an indication that confidence is returning albeit at a slow pace. According to the Bank of Namibia, businesses in the transport, mining, health, and service sectors have become the main contributors to businesses’ credit growth due to the high demand for other loans and advances and it has been on an upward trajectory since the beginning of the year. However, the demand for overdrafts for both households and businesses recorded no growth since January 2022. This speaks to the overall affordability of credit and tightening of overall general spending. See Figures 2 & 3.

Figure 1: Annual % growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2019- July 2022)

Figure 2: Annual % changes for Credit Extended to Businesses per category, (July 2021-July 2022)

Figure 3: Annual % changes for Credit Extended to Individuals per category, (July 2021-July 2022)

Outlook

Looking forward we expect credit growth to continue on a slow upward trend for the rest of the year 2022. This could be driven by improved credit scores for households especially mortgages as a result of an increase in housing benefits by 11% for government employees. However, the current interest rate hike cycle further possess a risk to the demand for credit as this further constrains consumers and business spending patterns.