Analysis

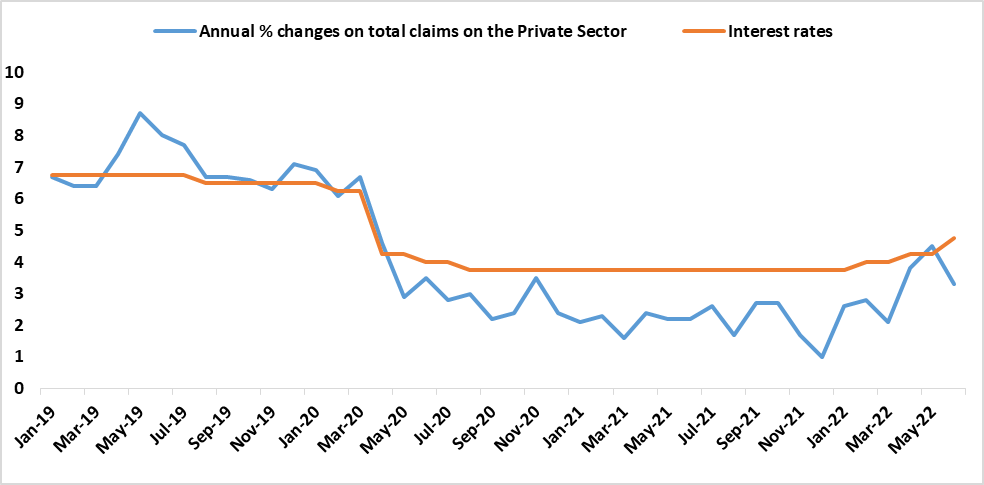

Total credit extended to the private sector (individuals and businesses) declined to N$ 108, 963 from N$ 109, 737 recorded in May 2022, which translates into a decline of 0.7%. The decline was driven by a drop in credit extended to businesses for the category of other loans and advances and the mortgages category for households. Additionally, the drop could also be attributed to a rise in the repo rate in June 2022 which resulted in a decrease in demand for credit for households and businesses. See figure 1 below. An increase in the repo rate has a negative impact on the demand for credit.

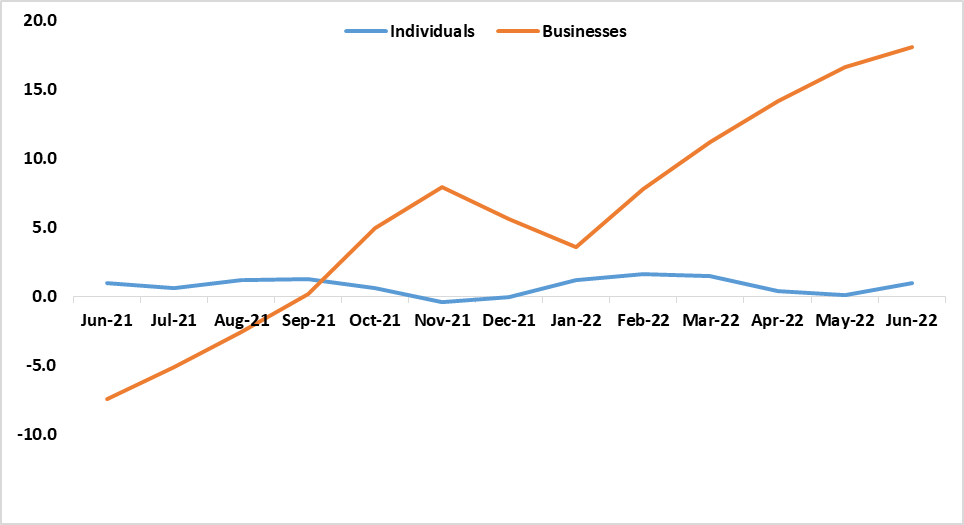

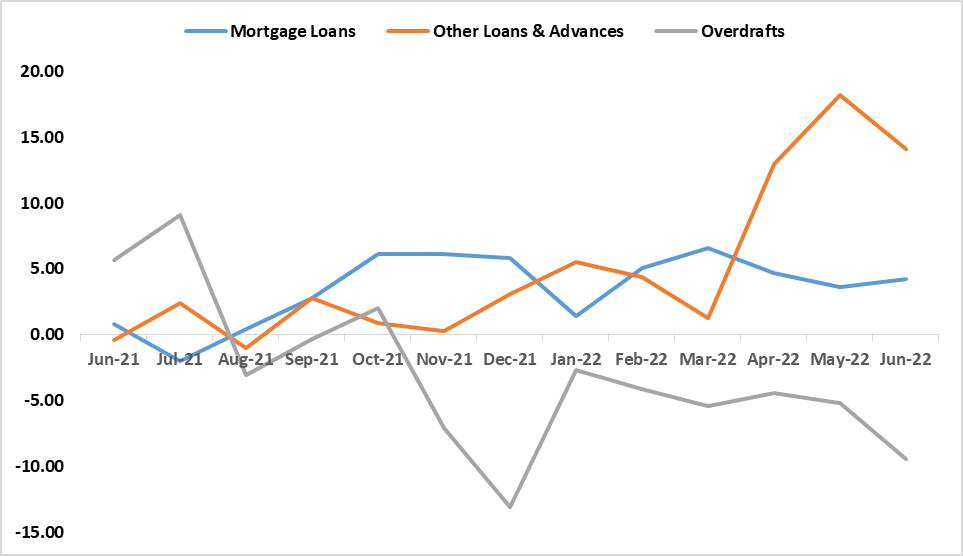

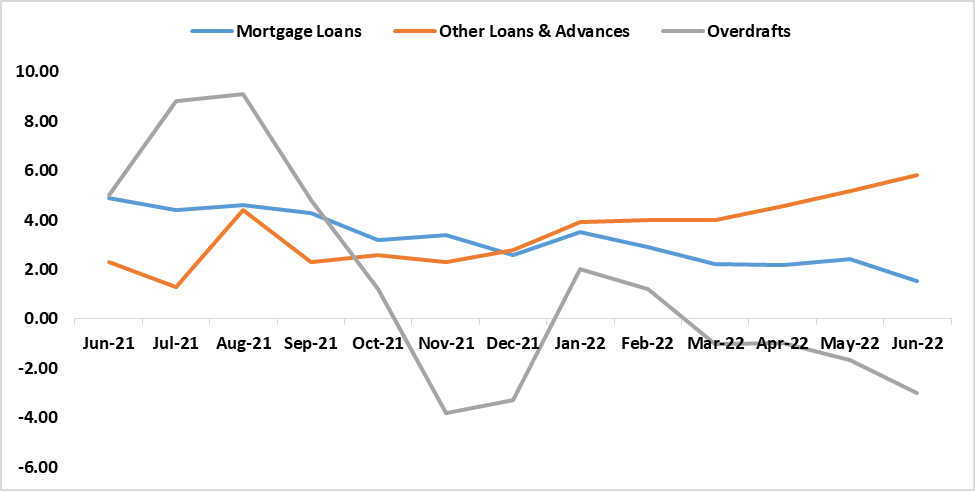

On an annual basis, total credit extended to the private sector increased by 3.3% up from 2.2% recorded in June 2021. An increase in the annual growth rate was mainly derived from growth recorded for installment and leasing for businesses and the uptake for other loans and advances for both households and businesses by 5.8% and 14.1% respectively. This is an indication that confidence is returning albeit at a slow pace. According to the Bank of Namibia, businesses in the energy, commercial, and mining sectors have become the main contributors to businesses’ credit growth due to the high demand for other loans and advances as it has been on an upward trajectory since June 2021. However, the demand for overdrafts for both households and businesses has declined significantly since the beginning of the year which speaks to the overall affordability and tightening of general spending. See Figures 3 & 4.

Figure 1: Annual % growth rates on Total Credit Extended to the Private Sector vs. Repo Rate, (January 2019- June 2022)

Figure 2: Individuals vs. Businesses Instalment and Leasing, Annual % Changes, (June 2021-June 2022)

Figure 3: Annual % changes for Credit Extended to Businesses per category, (June 2021-June 2022)

Figure 3: Annual % changes for Credit Extended to Individuals per category, (June 2021-June 2022)

Outlook

The current interest rate hike cycle means that the Bank of Namibia will increase the repo rate at its next MPC meeting. This could mean a further tightening of household and business credit. We expect a sluggish recovery in credit extension in the short to medium term.