Background

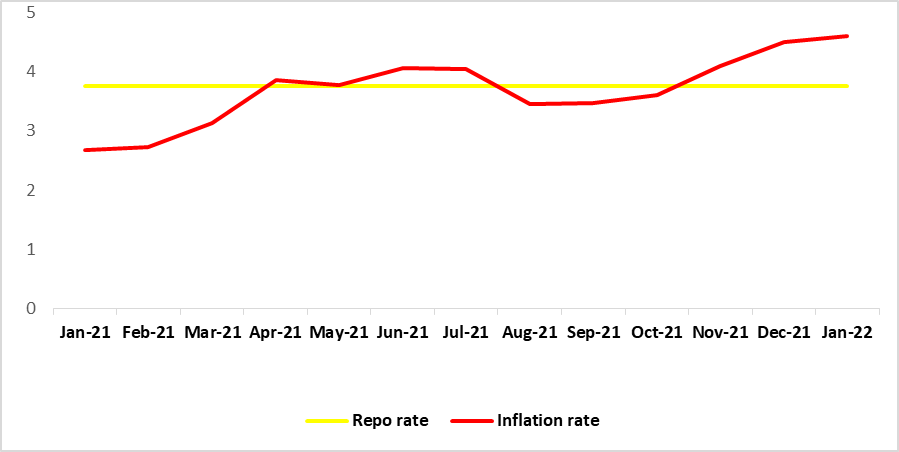

The Bank of Namibia Monetary Policy Committee (MPC) is set to make its first announcement for the year 2022 on the interest rate decision on the 16th of February 2022. The MPC kept the repo rate unchanged at 3.75% since August 2020 as it remained appropriate for supporting the ailing domestic economy at the back of the negative impact of the Covid-19 pandemic, while at the same time safeguarding the one to one link between the Namibian dollar and the South African Rand (see figure 1 below).

During the third quarter of 2021 the domestic economy recorded a growth of 2.4%. The expansion of economic activities in the third quarter of 2021 was observed in almost all the sectors of the economy, with double digits registered in mining and quarrying and hotels and restaurants sectors that recorded growths of 41.9% and 19.5%, respectively.

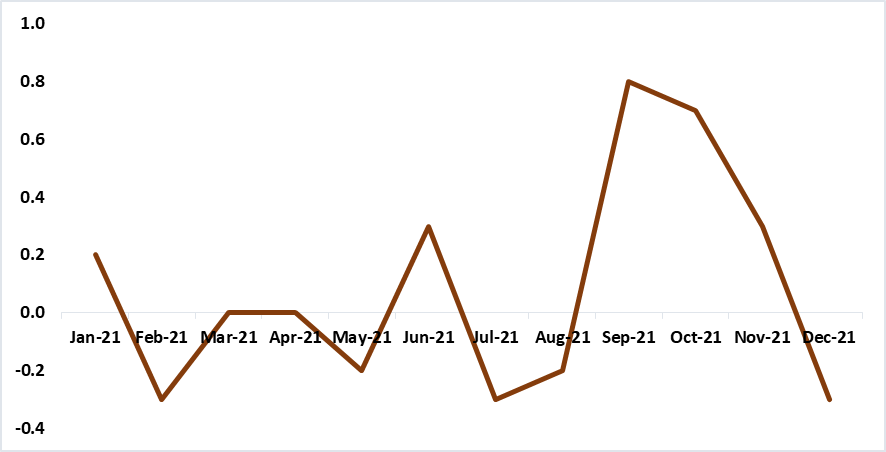

The annual inflation rate for Namibia continued on an upward trend, reaching up to 3.6% on average for 2021. High inflation rates are linked to higher global producer prices and a rise in commodity prices. This continues to pose a huge risk to the sustainability of the current level of the repo rate. Additionally, the uptake in private sector credit extension has been slow for the domestic economy on the back of the slow recovery in business and consumer confidence. (See figure 2 below).

Figure 1: Repo rate vs. Inflation rate, Namibia (January 2021- January 2022)

Figure 2: Monthly % growth rate of the PSCE, Namibia (Jan-Dec 2021)

Outlook

Given the current variation between the Bank of Namibia and South Africa Reserve Bank, we anticipate for further sustained increases in the repo rate for 2022.