Background

As the world strives to bring Covid-19 under control, fiscal policy remains key to address the impacts of the still-evolving pandemic, which continues to be marked by uncertainty. In the last quarter of 2021 the Omicron variant was associated with the resurgence of the virus. The fiscal support, especially in advanced economies, and vaccination have saved countless lives and facilitated an economic rebound. The interplay between vaccines and the virus and its variants is among the factors contributing to elevated uncertainty going forward.

The IMF (2021) made the point that fiscal policy need to respond to these challenges and facilitate the transformation of the global economy to make it more productive, inclusive, green, and resilient to future health or other crises.

At the same time, it will be crucial to ensure transparency and accountability, plot a medium-term path to rebuilding fiscal buffers, and make progress toward the Sustainable Development Goals.

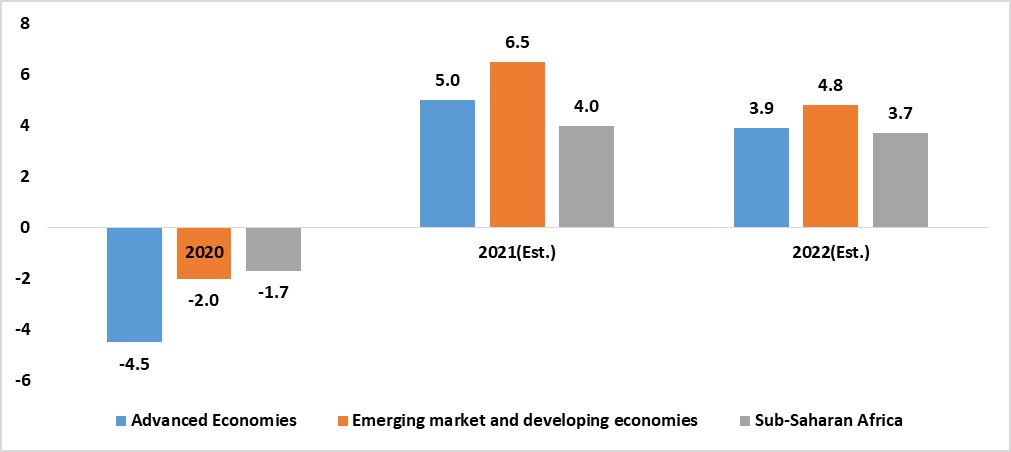

Global Outlook

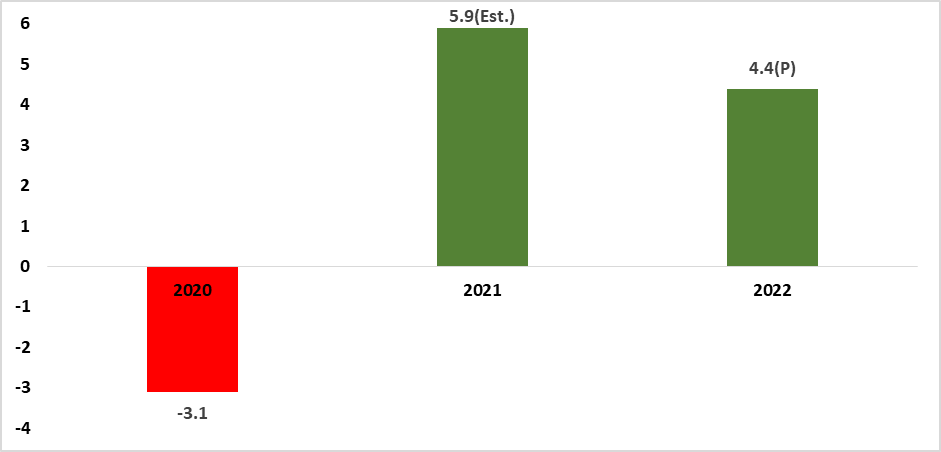

Global growth is estimated at 5.9% in 2021 and is expected to moderate to 4.4% in 2022(See figure 3). The anticipated effects of mobility restrictions, border closures and health impacts from the spread of the Omicron variant. The countries impact could vary depending on population demographics, the severity of mobility restrictions, the impact of infections on labor supply, and the importance of travel retail sectors. These impediments are expected to weigh on growth in the first quarter of 2022. The negative impact is expected to fade starting in the second quarter, assuming that the global surge in Omicron infections abates and the virus does not mutate into new variants that require further mobility restrictions.

The rise in inflation is expected to persist for longer than envisioned with ongoing supply chain disruptions and high energy prices anticipated to continue in 2022. Assuming inflation expectations stay well anchored, inflation should gradually decrease as supply-demand imbalances wane in 2022 and monetary policy in major economies responds.

Sub-Saharan Africa

The sub-Saharan Africa will be the world’s slowest growing region in 2022. According to IMF, the region is projected to record a growth of 3.7% in 2022(see figure 4).The global economy improved more rapidly than expected in the second half of 2021, with spillovers to the region in the form of increased trade, higher commodity prices, and a resumption of capital inflows.

The height of the Covid-19 pandemic crisis led policy discussion to different phases of the pandemic: immediate actions to save lives and livelihoods; near-term initiatives to secure a recovery once the acute phase of the crisis had passed; and then longer-term measures to build a more resilient and sustainable economy. For sub-Saharan Africa, however, all these phases may overlap, leaving authorities in the position of trying to boost and rebuild their economies while simultaneously dealing with repeated outbreaks as they arise.

The South Africa’s economy declined by 7% in 2020. A better-than-expected fourth quarter prompted an upward revision for 2021 although this will likely be offset by the third Covid-19 wave, which peaked in the fourth quarter and led to the reintroduction of some containment measures. The net impact will be a growth rate of 1.7% in 2021. Looking ahead, authorities have embarked on an ambitious vaccination program, which could limit the risk of additional waves if implemented swiftly. However, the scarring effects of the crisis, rising inequality, chronic electricity shortages, and product and labor market rigidities will likely weigh on growth over the medium term, limiting the economy’s ability to take advantage of the improving global environment albeit at the back of the Omicron variant.

Namibia

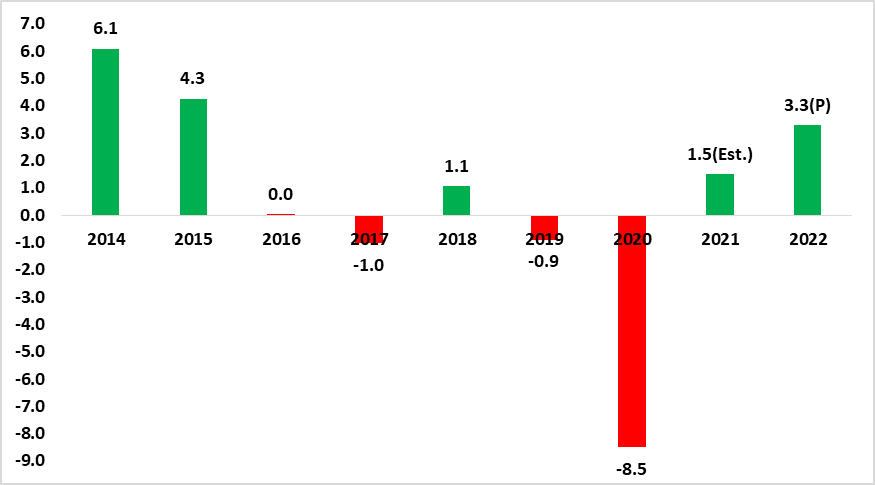

According to the Bank of Namibia, the domestic economy is projected to grow by 1.5% and by 3.3% in 2021 and 2022, respectively. This represents an improvement from 8.5% contraction recorded during the year 2020(See figure 2 below). The projected improvements are mainly due to base effects and better growth prospects for the mining industry and most of industries in the tertiary sector.

The Covid-19 pandemic is expected to remain a recovery and health risk going forward and therefore, fast recoveries in sectors that depend on travelling such as travel retail and accommodation are not expected in the short to medium term. Additional risks include an upsurge in the prices of goods and services locally. The Covid-19 pandemic has led to the monetary policy decision makers cutting the repo rate to its lowest levels of 3.75% with the aim to caution the ailing domestic economy due to the negative impact of Covid-19. This time around the policy makers could be left with no choice but to increase the rate further to control the rise in inflation.

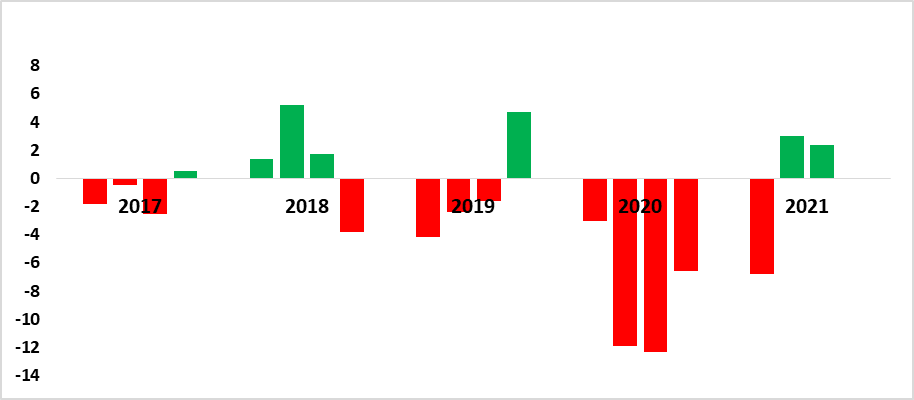

During the year 2021 the Namibian economy recorded growth in the second and third quarters respectively, however this growth was derived from a very low base effects of the subdued economic activities in the year 2020. Namibia recorded growth in real gross domestic product in the second and third quarter of 2021, recording 1.6% and 2.4% growth respectively. The much anticipated growth in the economy in the second quarter of 2021 was observed across all sectors except for the agriculture and forestry, mining and quarrying, manufacturing, water and electricity, construction and financial services sectors. The positive growth in real GDP recorded during the third quarter of 2021 came from all the sectors with the exemption of construction, financial services, manufacturing and wholesale and retail trade sectors. Overall growth in real GDP for the third quarter of 2021 was mainly driven by growth recorded for the tertiary sector specifically the education and real estate and professional services activities sectors.

Outlook

According to IMF (2022) Sub-Saharan Africa economic region recorded a contraction of 1.7% in real economic output during the year 2020. This was due to the negative impact of the covid-19 pandemic. The economy for the Sub-Saharan Africa is estimated to grow by 4.0% for the year 2021 and grow by 3.7% in 2022 respectively. See figure 4 below.

On the domestic front, the global supply chain bottlenecks brought by the pandemic, high commodity prices, high inflation rate, subdued tourism industry, slow growth in the private sector credit extension and underwhelming rainfall received across the country paints a gloomy picture for the Namibian economy for the year 2022. Namibian consumers and producers could be under pressure and this will result in poor economic output for the year. Notwithstanding this, we anticipate for a minimal growth for the economy ranging between 1 and 2%. This growth is anticipated to be derived from very low base effects due to the continuous negative impact of the Covid-19 pandemic on the economy. The necessary fiscal discipline and clear communication of policy priorities, backed by fiscal transparency have the potential to reduce borrowing costs.

Figure 1: Quarterly real GDP growth rates, (2017-2021)

Figure 2: Real GDP annual growth rates, 2014-2022

Figure 3: Global Growth outlook

Figure 4: World Economic regions projections