Background

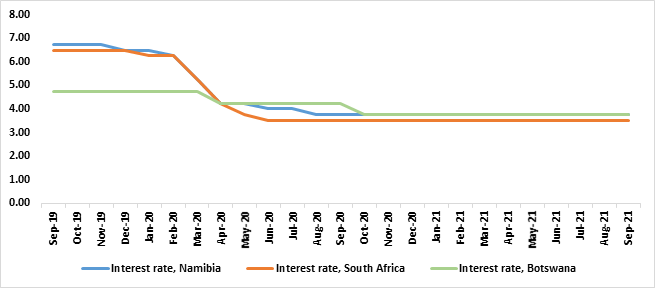

The Bank of Namibia Monetary Policy Committee (MPC) is set to make its fifth announcement on the interest rate decision for 2021 on 20 October 2021. The MPC kept the repo rate unchanged at 3.75% in their last meeting as it remained appropriate to continue supporting the weak domestic economy, while at the same time safeguarding the one-to-one link between the Namibia Dollar and the South African Rand (see figure 1 below). The second quarter of 2021 saw the domestic economy growing with 1.6% and this was a consequence of the base effect.

However, the annual inflation rate for Namibia continues on an upward trend, reaching up to 3.5% on average for 2021. Inflation continues to pose a risk to the sustainability of the current level of the repo rate. Additionally, the private sector credit extension declined to 1.9% for August 2021 from 2.8% recorded for July 2021 due to lower demand for credit.

Figure 1: Repo rate, Namibia, Botswana, and South Africa (September 2019 – September 2021)

Outlook

Our projection is that, the MPC for Namibia will maintain the interest rate at 3.75% as the Central Bank sees it as accommodative. The private sector credit extension for Namibia remains subdued. Individuals and businesses confidence has not returned to the market and hence the subdued credit uptake. Structural reforms and policy support is required for the monetary policy to be effective in order for the domestic economy to be on the recovery path.