Background

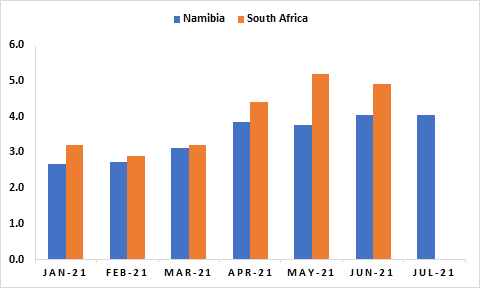

The Bank of Namibia Monetary Policy Committee (MPC) is set to make a fourth announcement on the interest rate decision for 2021 on 18 August 2021. The MPC kept the repo rate unchanged since the beginning of the year on the back of the negative impact of Covid 19 pandemic and as an attempt to cushion the sluggish economy. The Global inflation rate, and Sub Sahara had been on the upward trajectory since March 2021. Namibia and South Africa reached 4.1% and 5.2%. (See figure 1).

There is an upside risk to the prices of goods and services in the short to medium term for Namibia and South Africa. The risks emanate from rapid global producer price inflation, food price inflation, commodity prices, and the supply chain disruptions caused by the COVID-19 pandemic.

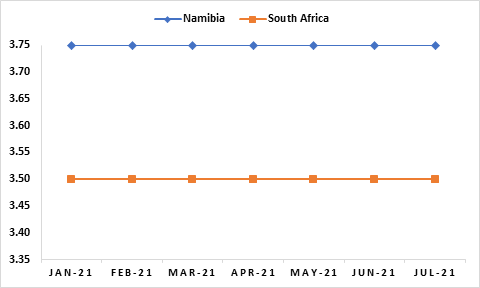

Since the beginning of the year 2021 the Bank of Namibia kept the at 3.75% to continue supporting the weak domestic economy while safeguarding the one-to-one link between the Namibian dollar. The South Africa Reserve Bank also maintained the interest rate on hold at 3.50% for the sixth consecutive time to support the ailing domestic economy due to the impact of the Covid-19 pandemic. (See figure 2).

Figure 1: Annual inflation rate, Namibia VS South Africa (JAN-JULY 2021)

Figure 2:Repo rate, Namibia VS South Africa (JAN-JULY 2021)

Outlook

We project that the annual inflation rate for Namibia will be on an upward trajectory but remain around the 3-6% South Africa target rate for 2021. Additionally, the private sector credit extension for Namibia remains subdued due to a lack of demand for credit caused by the impact of Covid-19 pandemic. Individuals and businesses remain uncertain on future income and return on investments and thus the hesitancy to take up credit. Our projection is that, the MPC will keep interest rate at 3.75% as it remains accommodative given the economic environment, However the expansionary fiscal policy stimulus and structural reforms are required for the monetary policy to be effective in order to support the sluggish domestic economy at the back of Covid-19.